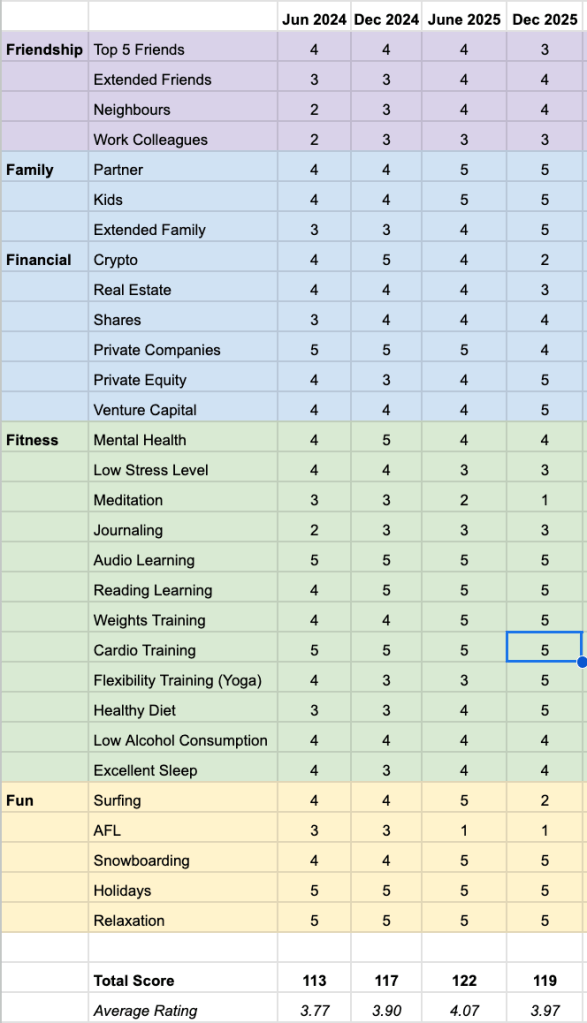

Each year I run a simple but brutally honest exercise on my life: The Five F’s Lifestyle Audit………Friendship, Family, Financial, Fitness and Fun.

I’ve written previously about how the framework works and why I use it (read that here), so I won’t repeat the mechanics. Instead, this article focuses on what the most recent data actually told me and why 2025 was a far more challenging year than the headline numbers suggest.

On the surface, my average score only slipped slightly from June 2025 to December 2025. But under the hood, the distribution tells a very different story.

A Small Evolution of the Framework

Before getting into the results, I made a couple of deliberate changes to the matrix itself in 2024:

- Added “Low Stress Level” as a specific Fitness metric

- Added “Snowboarding” under Fun (because it’s a meaningful, recurring part of my life)

- Removed “Networking” and “Acquaintances”

That last point is important. At this stage of life, I’m comfortable admitting that I don’t have surplus capacity for shallow relationships. Time is finite, energy is finite, and I’d rather invest both into depth over breadth.

The audit should reflect reality not aspiration.

2025: A Year of Transition (and Friction)

There were two primary drivers of stress throughout 2025, and both were structural rather than emotional.

1. Letting Go of a 15-Year Identity

In August 2025, I finished working at Reapit (who acquired Agentpoint in 2021).

That sounds clean on paper, but emotionally it wasn’t.

I’d been involved in building and running that business for over 15 years, and for the first time in that entire period I no longer had:

- A defined operating role

- A predictable monthly salary

- A clear professional identity to point to

Even when a transition is intentional, identity unwinding creates anxiety. You’re closing a chapter without fully knowing how the next one will read.

Normally, that would be manageable.

But this year, it wasn’t happening in isolation.

2. Cashflow Stress Changed Everything Else

As I’ve outlined in detail in my 2025 Annual Portfolio Review

(link here), we ran into genuine cashflow pressure during the year.

The causes were frustratingly specific:

- Large debts being called in unexpectedly

- Crypto materially underperforming expectations when we had positioned for a blow-off top

- Capital locked in private assets with limited short-term liquidity

The result wasn’t portfolio failure……. it was loss of control.

And that matters.

When you lose control of cashflow, it doesn’t stay neatly contained inside the “Financial” column. It bleeds into everything else.

How Financial Stress Cascaded Across the Five F’s

Friendship Took the First Hit

One of the most confronting insights from the matrix was seeing my Top 5 Friends score drop from 4 to 3 by December.

The reason wasn’t conflict, it was absence.

For the final six months of the year, I was consumed with:

- Scrambling to generate income

- Re-establishing predictability

- Managing uncertainty

And the trade-off was time.

Time with people who matter most was quietly deprioritised…….not intentionally, but inevitably.

That’s the danger of prolonged financial stress: it narrows your world.

Fitness Improved…..But at a Cost

Ironically, Fitness scores improved in several areas, but not for the reasons I would’ve chosen.

In 2025 I dealt with:

- An MCL tear in my left knee

- A meniscus tear in my right knee

These injuries forced a shift:

- Less intensity

- More rehabilitation

- More yoga and mobility work

Physically, this was a net positive in many respects. My flexibility, strength balance and long-term joint health improved.

But something else quietly slipped.

Meditation Fell Away (When I Needed It Most)

One of the clearest regressions in the audit was Meditation, dropping steadily through the year.

In hindsight, that’s exactly backwards.

As physical rehab increased, mental recovery decreased, even though mental stress was rising.

More yoga.

Less meditation.

And while yoga helped my body, it didn’t fully offset the cognitive load of prolonged uncertainty.

That’s a lesson I’m taking forward very deliberately.

Family: The Anchor That Held

If there’s one area that remained consistently strong, it was Family.

Partner and Kids both held at 5 by December, and Extended Family improved materially across the year.

That wasn’t accidental.

When other areas became unstable, family time became non-negotiable. It acted as a stabiliser, emotionally and structurally and reinforced why this audit exists in the first place.

Fun Was Polarised Not Reduced

Fun didn’t disappear in 2025, but it became highly concentrated.

- Snowboarding remained a clear high (45 days in 2025)

- Holidays and relaxation stayed strong (with the family each school holidays)

- Surfing dropped off sharply (due the knee injuries)

- AFL collapsed completely (due the knee injuries)

The Core Lesson: Financial Control Is Foundational

The most important insight from this audit is simple:

When you lose control of financial cashflow, it negatively overflows into every other domain of life.

Not immediately. Not catastrophically. But subtly and persistently.

Friendships thin.

Mental practices erode.

Decision-making narrows.

Even when the portfolio is sound, liquidity stress creates life stress.

That’s a mistake I won’t repeat.

Looking Forward

Going into 2026, my priorities are clear:

- Rebuild cashflow buffers, not just net worth

- Re-establish non-negotiable mental practices alongside physical training

- Be more intentional about protecting core friendships during periods of uncertainty

The Five F’s audit isn’t about perfection. It’s about seeing reality clearly enough to course-correct before damage compounds. And in that sense, 2025 did exactly what a good stress test should do.