As we enter 2026, we are pleased to report another year of solid performance across our diversified portfolio. For the 2025 calendar year, the portfolio delivered an annual return of 13.36%, bringing our Internal Rate of Return (IRR) to 16.31% per annum since we began tracking performance in January 2022. While this represents a modest decline from the 17.31% IRR recorded at the end of 2024, the result reflects the portfolio’s resilience through a year marked by elevated volatility, geopolitical uncertainty, and sharp dispersion across public markets.

Although we did not meet our long-term mandate of 14% net of fees and family expenses for the year, the portfolio’s compounded annual growth rate of 16.31% over the past four years continues to validate the strategy and positioning adopted across asset classes.

Economic & Geopolitical Backdrop – 2025

2025 was not a year of macro stability………it was a year defined by persistent uncertainty, rapid narrative shifts, and violent market rotations.

While headline inflation continued to moderate, the underlying global system felt increasingly fragile. Markets were forced to navigate geopolitical conflict, policy unpredictability, technological disruption, and growing scepticism around valuations, particularly in public equities.

Global Tensions Became Structural, Not Episodic

By 2025, geopolitical risk was no longer something markets reacted to occasionally………it became embedded into asset pricing.

Ongoing conflicts in Eastern Europe and the Middle East, combined with heightened US–China strategic competition, kept pressure on global energy markets, critical supply chains (semiconductors, rare earths, defence inputs), and international shipping routes. Rather than isolated shock events, these tensions created a permanent risk premium, most visible in public markets where capital flows are highly sentiment-driven.

Policy Uncertainty and Trump’s Impact on Markets

A major contributor to volatility throughout the year was policy uncertainty associated with Donald Trump’s return to power.

Markets spent much of 2025 attempting to price:

- Aggressive tariff rhetoric and trade policy uncertainty

- A more transactional, nationalist approach to global alliances

- Pressure on central bank independence

- The reshaping of global supply chains around domestic priorities

While certain sectors benefited…….. defence, domestic manufacturing, energy …….the broader impact was higher volatility and lower conviction multiples for globally exposed businesses.

The AI Trade: From Gold Rush to Scrutiny

AI remained the dominant secular theme of 2025, but the narrative evolved meaningfully as the year progressed.

Early in the year, capital flowed aggressively into AI infrastructure, semiconductors, data centres, and cloud compute platforms. By the second half of the year, crowding in the AI trade became increasingly evident. Investor focus shifted from inevitability to economics:

- Who actually captures the value?

- Which revenues are real versus narrative-driven?

- How much future growth is already priced in?

By year-end, concerns around an “AI bubble” were widely discussed……not because AI lacks substance, but because valuation dispersion became extreme. Core AI leaders held up well, while peripheral “AI-adjacent” names suffered sharp drawdowns. Public markets became far more selective and unforgiving.

Public Markets: Volatile, Narrow, and Unforgiving

Despite periods of reasonable index-level performance, the lived experience of investing in public markets during 2025 was challenging:

- Large intraday swings

- Violent sector rotations

- Sharp reversals without fundamental change

- Heavy reliance on a small number of mega-cap names

Passive exposure increasingly felt like concentration risk, not diversification.

How This Framed Portfolio Decisions

Against this backdrop, the portfolio remained deliberately positioned away from short-term sentiment risk:

- Overweight private companies and private equity, where value creation is driven by execution rather than headlines

- Selective, concentrated exposure to listed AI beneficiaries with real earnings leverage

- Minimal reliance on leverage

- Very low cash, but high embedded optionality

The objective was not to predict macro outcomes, but to own assets capable of compounding across regimes.

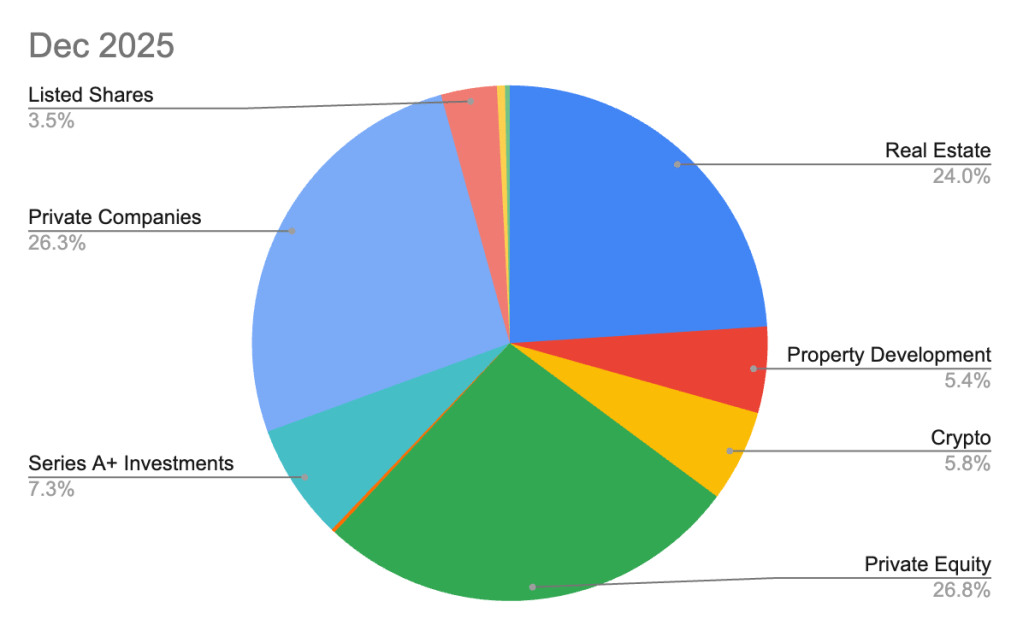

Portfolio Allocation – December 2025

| Asset Class | Dec 2022 | Dec 2023 | Dec 2024 | Dec 2025 | Status |

|---|---|---|---|---|---|

| Real Estate | 29.7% | 26.2% | 25.2% | 24.0% | Neutral |

| Property Development | 6.4% | 1.5% | 4.8% | 5.4% | Neutral |

| Crypto | 8.2% | 6.7% | 12.0% | 5.8% | Neutral |

| Private Equity | 20.6% | 26.3% | 21.8% | 26.7% | Overweight |

| Venture Capital | 4.2% | 4.3% | 0.4% | 0.2% | Neutral |

| Series A+ Investments | — | — | 7.4% | 7.3% | Underweight |

| Private Companies | 27.6% | 27.1% | 25.4% | 26.3% | Overweight |

| Listed Shares | 0.5% | 1.2% | 3.0% | 3.5% | Underweight |

| Hedge Funds | — | — | — | 0.5% | Underweight |

| Cash | 2.8% | 6.7% | 0.0% | 0.3% | Underweight |

| Total | 100% | 100% | 100% | 100% | — |

| Debt | 17.8% | 28.9% | 29.16% | 24.99% | — |

IRR Performance by Asset Class

| Asset Class | IRR @ Dec 2025 | Year Commenced | Years Compounding | IRR @ Dec 2024 |

|---|---|---|---|---|

| Real Estate | 3% | 2017 | 8 | 3% |

| Property Development | 13% | 2023 | 3 | 0% |

| Crypto | 8% | 2017 | 8 | 25% |

| Private Equity | 29% | 2020 | 6 | 27% |

| Venture Capital | -16% | 2019 | 7 | 0% |

| Series A+ Investments | 35% | 2021 | 5 | 43% |

| Private Companies | 57% | 2015 | 11 | 57% |

| Listed Shares | 35% | 2021 | 5 | 53% |

| Hedge Funds | 7% | 2021 | 5 | — |

| Portfolio | 17.31% | — | — | 17.31% |

Performance Commentary

Private Companies (57% IRR)

Once again, private companies were the dominant contributor. Long-duration compounding driven by execution, founder alignment, and deep domain expertise continues to outperform public alternatives. While IRR remained flat year-on-year, this segment generated meaningful income and dividends, providing valuable cash flow to the family office.

Private Equity (29% IRR)

Delivered strong, consistent returns with lower volatility than public markets. Revaluations reflected one investment preparing for a potential CY2026 exit and another materially improving operations after resolving legacy issues.

Series A+ Investments (35% IRR)

Performance was driven by execution rather than multiple expansion. CareExpert had an excellent year, evolving its revenue model, securing strategic investment from Trade Me, and launching via a JV in New Zealand. A potential IPO in late 2026 or early 2027 remains the base case.

Listed Shares (35% IRR)

Returns were driven by a small number of AI-exposed positions. Broader performance was mixed, with crypto-related equities contributing to drawdowns exceeding 30% in some cases.

Hedge Funds (New Asset Class)

Hedge funds were formally introduced as a standalone allocation in 2025. While previously grouped within listed equities, they now represent a deliberate set-and-forget allocation to specialist managers across public and private markets. Allocations remain small as long-term manager quality is assessed.

Crypto (8% IRR)

After a strong 2024, 2025 was disappointing. Most tokens declined materially, with Solana down ~37%. Despite this, the long-term thesis remains intact, with one final leg higher expected in 2026 before the next bear market.

Property Development (13% IRR)

Marked improvement as construction commenced, slabs were poured, and an off-the-plan sale established a clear valuation benchmark.

Real Estate (3% IRR)

Delivered stable, modest returns and continues to act as portfolio ballast.

Venture Capital (-16% IRR)

One full write-off was partially offset by another investment paying dividends and re-rating positively.

Portfolio Debt

Between November 2024 and May 2025, portfolio debt was materially reduced. Liquidity was tight as capital was tied up in illiquid assets and exits occurred at sub-optimal prices. Despite this, leverage was reduced from ~29% to under 25%, improving resilience in a volatile environment.

Key Reflections from 2025

Private markets continue to offer the clearest edge, particularly where execution, control, and long-term alignment drive outcomes rather than short-term sentiment.

Concentration outperformed diversification, with a small number of high-conviction positions responsible for the majority of returns. That said, 2025 reinforced an important nuance………diversification still matters. Strong performers were able to more than offset areas that underperformed, most notably crypto.

AI is real………but valuation discipline matters. The opportunity is structural, but dispersion between winners and losers continues to widen.

Liquidity planning is increasingly important in private-heavy portfolios. 2025 was uncomfortable from a personal cash-flow perspective, requiring close budgeting and monitoring. While cash loses value over time, maintaining at least 12 months of living expenses in readily accessible cash provides both resilience and the ability to deploy capital during frequent 20%+ market drawdowns.

Looking Ahead to 2026

The setup entering 2026 is one of the most interesting in the past decade:

- Stabilising interest rates

- Accelerating AI adoption

- Normalised private-market valuations

Focus Areas

- Increasing exposure to Series A+ opportunities

- Selective expansion in public AI infrastructure

- Harvesting mature private-company positions

- Continued reduction of low-return real estate exposure

The goal remains unchanged:

Compound capital at 15–20% annually while avoiding permanent loss.

2025 reinforced a simple but enduring truth………..disciplined positioning, not prediction, remains the most reliable long-term strategy.