In Technology Has Been Eating the World, But It’s About to Exponentially Consume It, I explored how innovation compounds exponentially……how AI, data, and automation are reshaping everything from productivity to investing.

And in Why a 12% Annual Return Is Essential to Maintain Your Wealth, I argued that investors need sustained compounding just to stand still, given the erosion of purchasing power.

But this article sits above both ……zooming out to the structure of markets themselves: the long, sweeping arcs known as secular trends, and the cyclical booms and busts that sit inside them.

The Moment It Clicked

Up until recently, I didn’t truly understand the difference between secular and cyclical markets. Like many investors who began their journey after 2008, I’d only experienced a powerful secular bull market…………one where the trend was overwhelmingly up and to the right.

My default belief was simple:

The NASDAQ will rise forever.

Sure, there will be dips, but they always recover.

And while that’s broadly true over decades, I now understand something I completely missed:

Even in long-term secular bull markets, there are natural pauses — multi-year stretches where the market flatlines, consolidates, or goes nowhere.

The lightbulb moment happened after diving deep into the research and video analysis from IO Fund, which I subscribe to as a PRO member. Their work is exceptional. The way Knox Ridley dissects market structure……. layering technical frameworks, macro cycles, and microtrend analysis, is the clearest I’ve ever seen.

Their investment approach is outstanding, and their financial performance since inception is genuinely mouth-watering. For any serious investor, their PRO service is one of the few subscriptions I’d strongly recommend.

It was through their data and explanations that I finally saw the bigger picture:

Markets move in eras — not straight lines.

And that realisation explained a mistake I’d made elsewhere: crypto.

One of my biggest misjudgments was believing that market cycles “don’t apply” to crypto. I fell for the idea that Bitcoin had entered a “supercycle” and that the bull market would never end.

What a fool I was.

Crypto has cycles just like every other asset class…….booms, busts, consolidations…….all nested within a larger secular trend. Even Bitcoin, despite being in a secular bull market since inception, will eventually plateau into a secular bear.

Understanding secular vs cyclical behaviour has changed how I see every asset class.

The Long Game: What Are Secular Markets?

A secular bull market is a multi-decade period where the dominant trend is upward, driven by deep structural forces……..technological breakthroughs, demographics, productivity gains, and liquidity expansion.

A secular bear market is a long period of consolidation, where markets move sideways, digest excess valuations, and reset expectations.

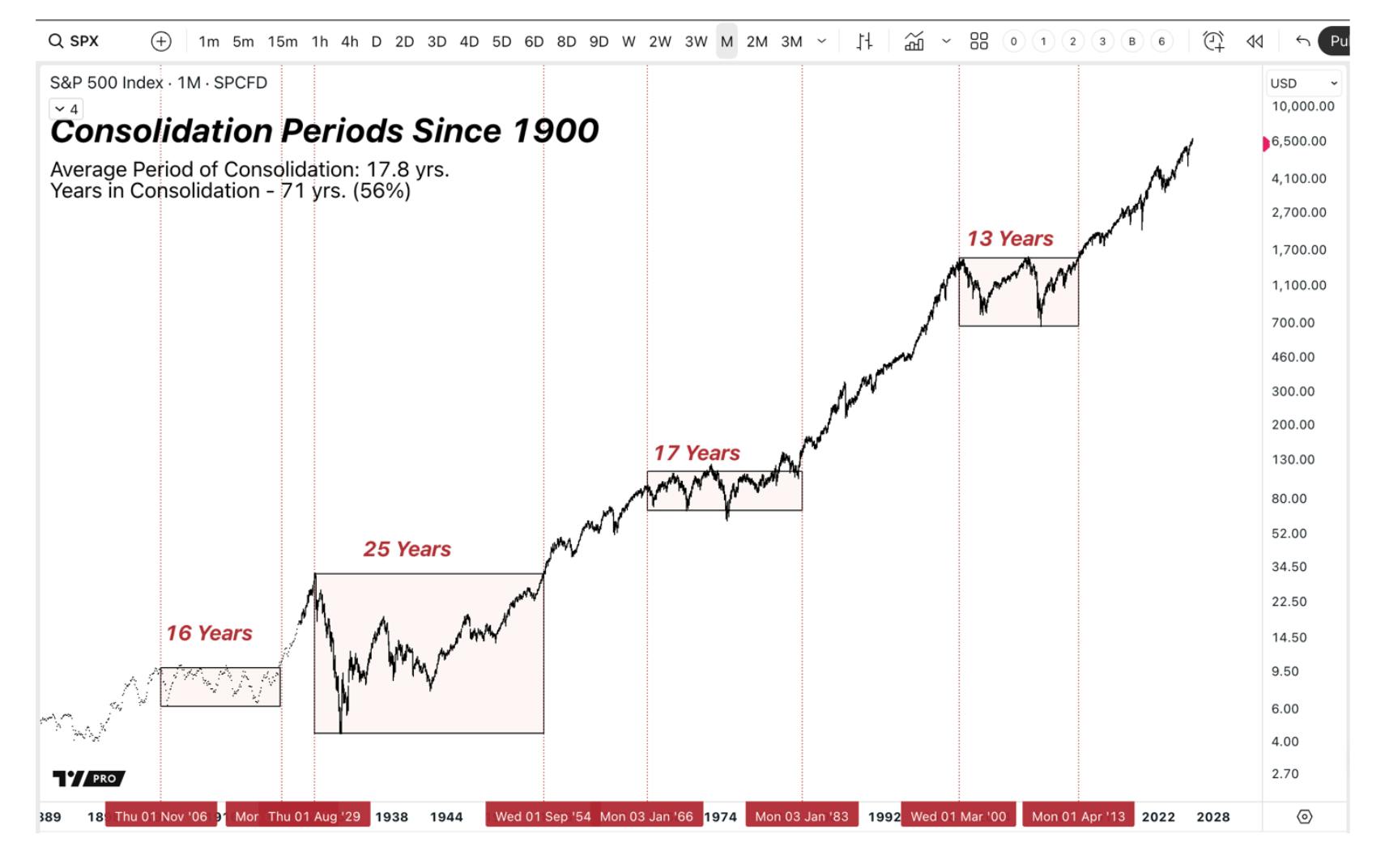

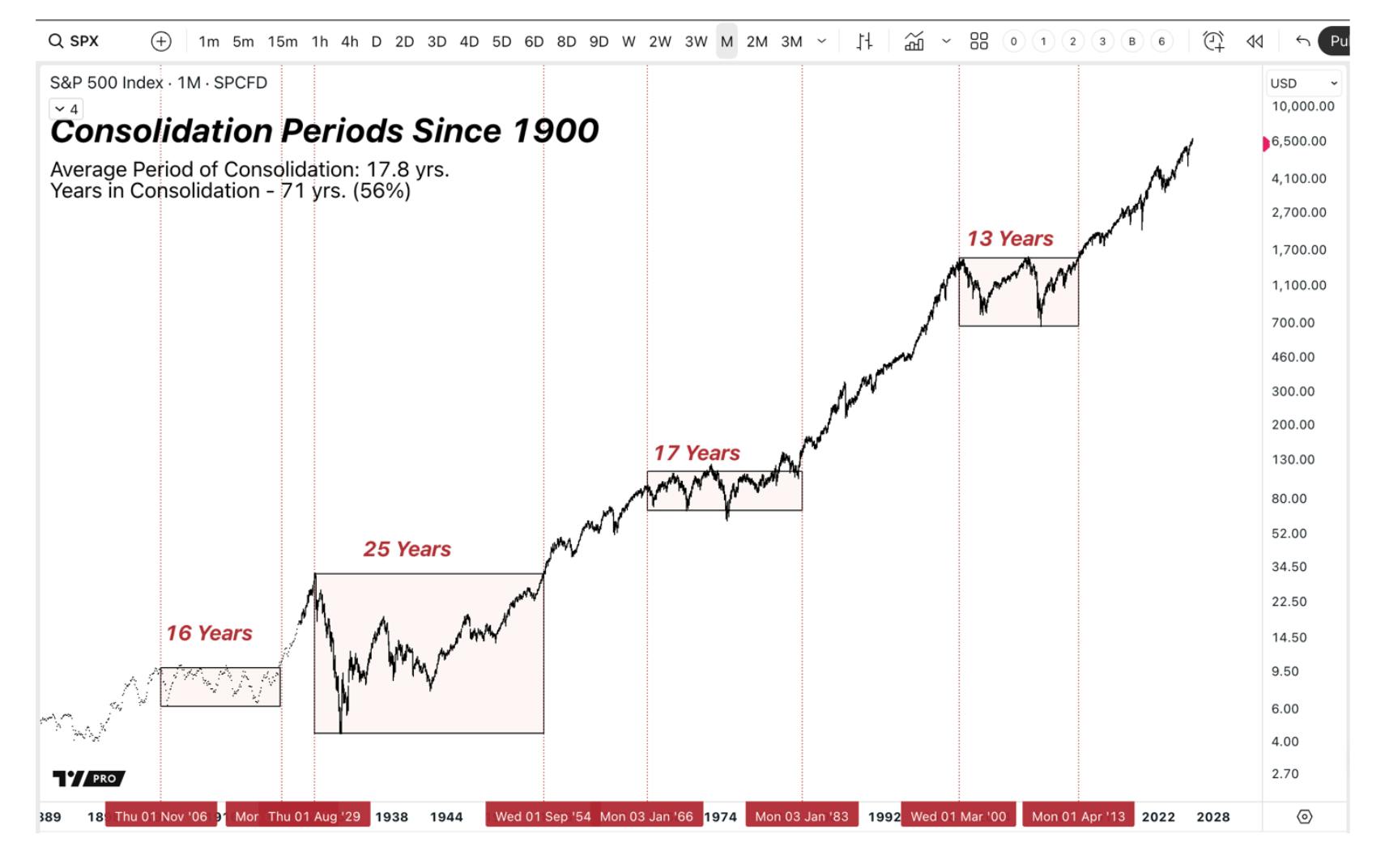

Looking at some charts produced by IO Fund (below) and some of their research. Since 1900, U.S. markets have spent 56% of the time in these sideways eras — more than half of modern financial history.

The Math of Long-Term Markets

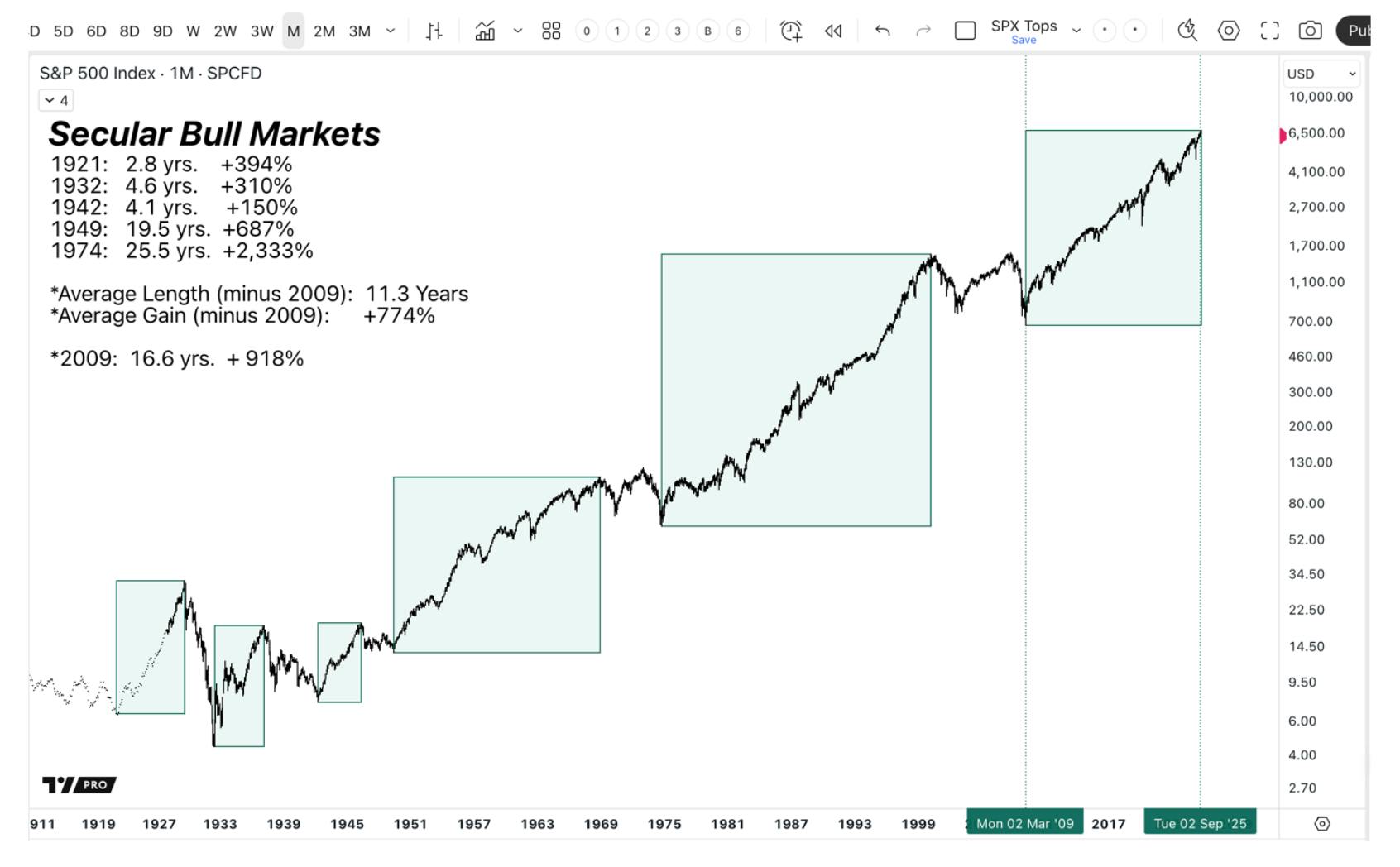

According to IO Fund’s research, the average secular bull market:

- lasts 11.3 years, and

- returns ~774%.

The current secular bull……..beginning after the 2008 Global Financial Crisis…….has already lasted 16.6 years and delivered 918%, making it the second most profitable in over a century.

History suggests that a period of consolidation, a secular bear, is a normal next step. Not a collapse. Not a crisis. Just the market’s long breath.

Cyclical vs Secular: Waves Within the Tide

Secular markets are the tide.

Cyclical markets are the waves within it.

In a secular bull, there can still be deep cyclical bear markets (e.g., 2022).

In a secular bear, there can be explosive cyclical bull rallies (e.g., 2003–2007).

Understanding the difference prevents misreading the entire environment …………confusing a bounce for a new era, or mistaking a correction for a collapse.

The Lost Decade: When Markets Go Nowhere

From 2000 to 2013, the S&P 500 spent 13 years going sideways.

Two major drawdowns.

Zero net progress.

Cisco (CSCO) — the star of the dot-com era — rose nearly 700%, then fell 90%, and took 22 years to reclaim its high.

Apple, by contrast, fell 83% but recovered by 2005 — and delivered 1,000% gains by 2013.

Why?

Cisco’s microtrend ended.

Apple’s microtrends multiplied…………personal computing, mobility, the smartphone.

IO Fund’s Philosophy: Microtrends Outlast Macro Cycles

As IO Fund explains, secular bears don’t kill innovation.

They reshape leadership.

New giants are minted during consolidation eras.

Old leaders fade as their microtrends mature.

Today’s equivalent?

Artificial Intelligence.

Even if the S&P enters a secular bear, AI may continue its secular march………..with cyclical drawdowns forming opportunities, not endings.

Just like Apple from 2007 to 2018, Nvidia appears to be in a long-term secular uptrend, with corrections along the way……..not reversals.

The Lesson: Don’t Confuse Cycles With Secular Trends

This has become one of the most important lessons of my investing life:

- Secular markets define the era.

- Cyclical markets define the opportunities within that era.

In equities and in crypto, I once assumed cycles didn’t matter. I now know that understanding these two layers — the “tide” and the “waves” — is essential.

It prevents overconfidence in bull markets.

It prevents despair in bear markets.

It keeps you focused on the right horizon.

The Takeaway

Secular markets set the direction of history.

Cyclical markets set the tempo of opportunity.

Once you learn to see both, you invest with clarity — and finally understand why markets sometimes run, sometimes rest, and sometimes explode.

Because while prices move in cycles…

progress compounds forever.