In my previous article, I outlined the psychological biases and behaviours that have repeatedly tripped me up as an investor. Understanding those biases was a big step, but knowing them wasn’t enough. I needed a simple framework I could actually use in real time……….before I buy, while I’m holding, and when I exit. That’s how the 3×3 Loop came about: three straightforward questions at each stage of an investment. It keeps me disciplined, limits emotional decision-making, and helps me avoid repeating the same costly mistakes.

The Simple 3×3 Loop – Buy • Hold • Exit

Buy – What • Why • How

- What: What is my thesis for this investment and what pre-set rules would prove that thesis wrong?

- Why: Why am I making this investment instead of another? What’s the opportunity cost?

- How: How much am I putting in, how much am I prepared to lose, and how will I enter (all at once or in stages)?

Hold – Check • Compare • Balance

- Check: Are the reasons I bought still valid, or has the thesis broken? This review happens monthly rather daily to avoid news/headlines cycles.

- Compare: If this were cash today, would I still buy it at this price or is there a better use of capital?

- Balance: Is the position still the right size for my portfolio and risk tolerance?

Exit – Trigger • Action • Lesson

- Trigger: Has a pre-set rule fired (thesis broken, valuation stretched, risk too high)?

- Action: How much will I sell, when, and where will the proceeds go (cash or a better idea)?

- Lesson: What worked, what didn’t, and what can I improve next time?

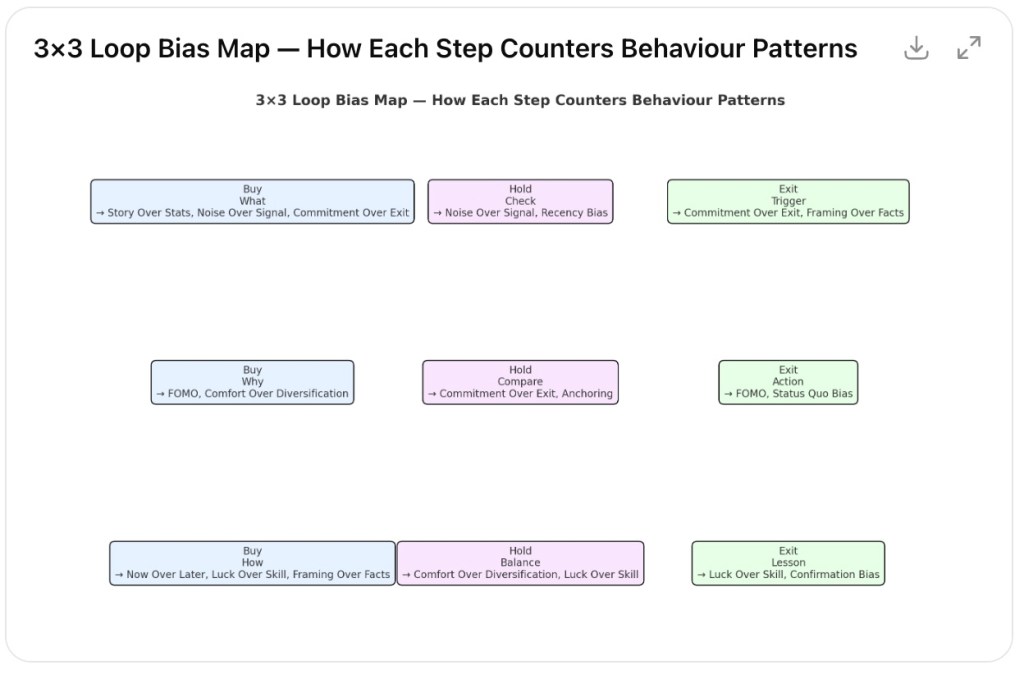

How the 3×3 Loop Helps Me Overcome Behavioural Biases

Buy

What: What is my thesis for this investment and what pre-set rules would prove that thesis wrong?

- Behaviour it solves: Prevents Story Over Stats (anchoring to a narrative), Noise Over Signal (reacting to headlines), and Commitment Over Exit (clinging without rules).

- How it helps: By writing down the specific reasons I’m buying and the kill criteria that prove me wrong, I anchor decisions to fundamentals, not hype. This forces me to exit if the thesis breaks, rather than hoping sentiment magically recovers.

Why: Why am I making this investment instead of another? What’s the opportunity cost?

- Behaviour it solves: Counters FOMO (jumping in just because something is moving) and Comfort Over Diversification (sticking to familiar names).

- How it helps: Comparing each decision against my next-best idea ensures I’m not just buying “because it looks good” but because it’s the best available use of capital. This kills the “fear of missing out” trap by reframing the choice as “this vs. that.”

How: How much am I putting in, how much am I prepared to lose, and how will I enter (all at once or in stages)?

- Behaviour it solves: Tackles Now Over Later (deploying all cash at once), Luck Over Skill (oversizing after wins), and Framing Over Facts (ignoring risk).

- How it helps: Setting position size, loss limits, and entry style in advance means I can’t overcommit in the heat of the moment. Layered entries also reduce the temptation to chase price spikes.

Hold

Check: Are the reasons I bought still valid, or has the thesis broken?

- Behaviour it solves: Stops Noise Over Signal (overreacting to headlines) and Recency Bias (projecting the latest move forward).

- How it helps: By reviewing monthly (not daily), I separate news flow from thesis facts. This avoids panic-selling on noise and instead evaluates whether the original fundamentals still hold.

Compare: If this were cash today, would I still buy it at this price or is there a better use of capital?

- Behaviour it solves: Counters Commitment Over Exit (waiting for “break-even”) and Anchoring (sticking to entry price).

- How it helps: The “as-if cash” test reframes the holding decision around opportunity cost. If I wouldn’t buy fresh today, I free up capital instead of staying anchored to my past purchase.

Balance: Is the position still the right size for my portfolio and risk tolerance?

- Behaviour it solves: Addresses Comfort Over Diversification (overweighting familiar names) and Luck Over Skill (letting winners bloat unchecked).

- How it helps: Regular rebalancing forces me to trim oversized winners and top up neglected areas, maintaining diversification and protecting against emotional concentration bets.

Exit

Trigger: Has a pre-set rule fired (thesis broken, valuation stretched, risk too high)?

- Behaviour it solves: Counters Commitment Over Exit (waiting for break-even) and Framing Over Facts (loss aversion).

- How it helps: Defining exit triggers in advance means I act on rules, not feelings. This prevents me from hoping a loser will “bounce back” or panic-selling at random.

Action: How much will I sell, when, and where will the proceeds go?

- Behaviour it solves: Prevents FOMO (selling without a plan to reallocate) and Status Quo Bias (just sitting in cash with no purpose).

- How it helps: By naming the destination for proceeds (cash buffer, next-best idea, or rebalancing), every exit becomes part of a broader plan rather than a knee-jerk move.

Lesson: What worked, what didn’t, and what can I improve next time?

- Behaviour it solves: Fixes Luck Over Skill (mistaking randomness for edge) and Confirmation Bias (only remembering the wins).

- How it helps: Writing a short post-mortem turns each trade into a learning loop. This keeps me honest about process vs. luck, and ensures I carry improvements forward.

Applying the 3×3 Loop to My 3rd Crypto Cycle

After losing capital in our first 2 crypto cycles we implemented this framework for our 3rd cycle starting with a new (and our last) investment in crypto back near the bottom of the last bear market in December 2022. We discussed these previous losses and this investment and plan in this article.

Below we outline how this multi-year investment thesis follows the 3*3 loop model and as you can see although we were aiming to exit by June 2025 as the kill criteria pre-set rules have not been met we are still in the investment as of today.

Buy – What • Why • How

What:

- Thesis: Crypto runs in clear 4-year halving-driven cycles that are tied to global liquidity along with the timing of USA based election cycles. This 4 year cycle has extreme boom-and-bust patterns. The plan is to accumulate quality assets (BTC, ETH, selected alts) in the accumulation/bear phase, ride the cycle into the next bull, and de-risk progressively as sentiment peaks.

- Kill criteria: If adoption metrics stall (on-chain activity, institutional inflows, developer activity or peak cycle indicators) or regulatory risks fundamentally change the market structure, the thesis breaks.

Why:

- Why crypto now: Historically, cycle bottoms have delivered outsized returns over 2–4 years. This phase offers asymmetric upside compared to late-cycle entry.

- Opportunity cost: Compared with equities or property, crypto remains the highest-risk/highest-reward slice of the portfolio — but only a capped percentage.

How:

- Position size: Crypto capped at ~10–15% of total portfolio.

- Downside tolerance: Expectation that individual assets may retrace 50–70% in cycle downturns.

- Entry strategy: Lump sum investment into Ether (largest layer 1 blockchain)

- Stress test: If BTC dropped 50% further then continue to hold; if it broke structural adoption trends, reduce exposure.

→ Current result: Executed on the plan and currently playing out

→ Biases neutralised: Stops FOMO (buying late), Noise Over Signal (chasing headlines), and Story Over Stats (believing “this time it’s different”).

Hold – Check • Compare • Balance

Check:

- Review cadence: Monthly reviews, not daily. Focus on cycle health (BTC dominance, MVRV ratios, liquidity flows) instead of news noise. Latest BTC Cycle review here.

- Thesis validity: As long as adoption metrics and halving cycle dynamics hold, maintain positions.

Compare:

- As-if cash: If this capital were cash today, would I still deploy it into BTC/ETH at these levels, or into a different asset? Answer is still yes today, I would buy the crypto I hold at the current prices.

- Opportunity cost: Compare crypto exposure vs. equities/property alternatives plus various crypto alt-coins. Crypto has been one of the top performing assets in our portfolio over the past 18 months and we think this will continue for at least another 2 – 3 months.

Balance:

- Portfolio weight: Keep crypto within the pre-set allocation bands. If prices run and crypto grows beyond 15% of the portfolio, rebalance by trimming.

- Diversification: Maintain balance between BTC, ETH, and selective alts rather than over-weighting the “shiny coin of the month.”

→ Current result: Moved out of Ether into Solana and Chainlink. Moved out of Chainlink into Sui. During 2025 Calendar year have rebalanced some into cash and withdrawn this from the Crypto ecosystem to cover cashflow for living.

→ Biases neutralised: Stops Commitment Over Exit (clinging to losers), Comfort Over Diversification (overweighting familiar alts), and Recency Bias (exiting on short-term volatility).

Exit — Trigger • Action • Lesson

Trigger:

- Pre-set rules: Begin trimming when BTC/ETH enter late-cycle parabolic phases (sentiment extreme, valuations stretched vs history, funding rates overheated).

- Macro risk: Exit or reduce if regulatory clampdowns fundamentally impair liquidity or stablecoin infrastructure.

Action:

- Execution: Staged exit — sell portions into strength rather than trying to “time the top.”

- Destination: Rotate proceeds into safer assets (cash buffer, equities, or property) to lock in cycle gains.

Lesson:

- Reflection: After prior cycles (2017, 2021), holding too long and believing the narrative cost significant profits. This cycle, process > emotion.

- Improvement: Stick to staged de-risking regardless of “this time is different” narratives.

→ Current result: Slowing selling down crypto holdings and moving cash out of ecosystem.

→ Biases neutralised: Stops Luck Over Skill (mistaking cycle luck for edge), Framing Over Facts (ignoring downside in euphoric framing), and Disposition Effect (waiting to get back to even).

Closing Thought

The 3×3 Loop doesn’t remove my biases……..but it helps me manage them. Each step forces me to pause, test my reasoning, and stay anchored to process over emotion. By linking every decision to a clear What, Why, and How on entry, a disciplined Check, Compare, and Balance while holding, and a rules-based Trigger, Action, and Lesson at exit, I give myself the best chance of avoiding the traps that have cost me in the past and to let long-term compounding do its work.