As we start 2025, we are pleased to report another year of strong performance across our diversified portfolio. With an annual return of 22.26% for the 2024 calendar year, our Internal Rate of Return (IRR) now sits at 17.31% per year since we began tracking it in January 2022, reflecting the continued resilience and strategic alignment of our investment approach.

The year 2024 was shaped by significant global developments and surprising market resilience, defying earlier predictions of economic instability. Against a complex backdrop, several key themes emerged across macroeconomic, geopolitical, and sector-specific domains.

Economic and Geopolitical Backdrop

- Interest Rates and Inflation: Central banks moderated the aggressive rate hikes of 2023, with a lot of them (excluding Australian) beginning to cut rates late in the year. Inflation, while persistent in certain regions, showed signs of easing in some markets.

- Geopolitical Tensions: Global unrest persisted, with the Russia-Ukraine conflict continuing to impact energy markets. Tensions in the Middle East escalated with regional conflicts centred around Israel, contributing to volatile commodity and oil prices.

- US Elections: The re-election of Donald Trump fueled market optimism, with the “Trump rally” sparking gains in US equities and bolstering investor confidence.

- China’s economic slowdown: Marked by reduced demand for Australian commodities, impacted Australia’s exports and weakened the Australian dollar.

Sector Highlights

- Technology and AI: Tech equities, particularly those focused on artificial intelligence (AI), continued their upward trajectory. The integration of AI into operations drove transformative growth across sectors, with corporate adoption accelerating further.

- Real Estate: Predictions of stagnation or decline in the property market were defied once again. Blue-chip suburbs in cities like Sydney and Brisbane saw sustained growth, bolstered by a return of international migration and robust demand for high-quality assets.

- Cryptocurrency: Crypto markets experienced a “blockbuster” year as institutional adoption surged. The launch of US-based BTC and ETH ETFs, coupled with strong price growth, saw BTC and tokens like Solana achieve gains of over 100%.

- Private Equity and Venture Capital: These sectors saw selective activity. While broader market conditions tempered enthusiasm, some funds capitalised on opportunities to acquire undervalued, cash-flow-positive businesses. Revaluations in key PE and VC holdings provided steady returns.

- Property Development: Rising construction costs and delays remained a challenge, but demand for well-located developments continued, particularly in lifestyle-oriented regions like Queensland.

Portfolio Breakdown

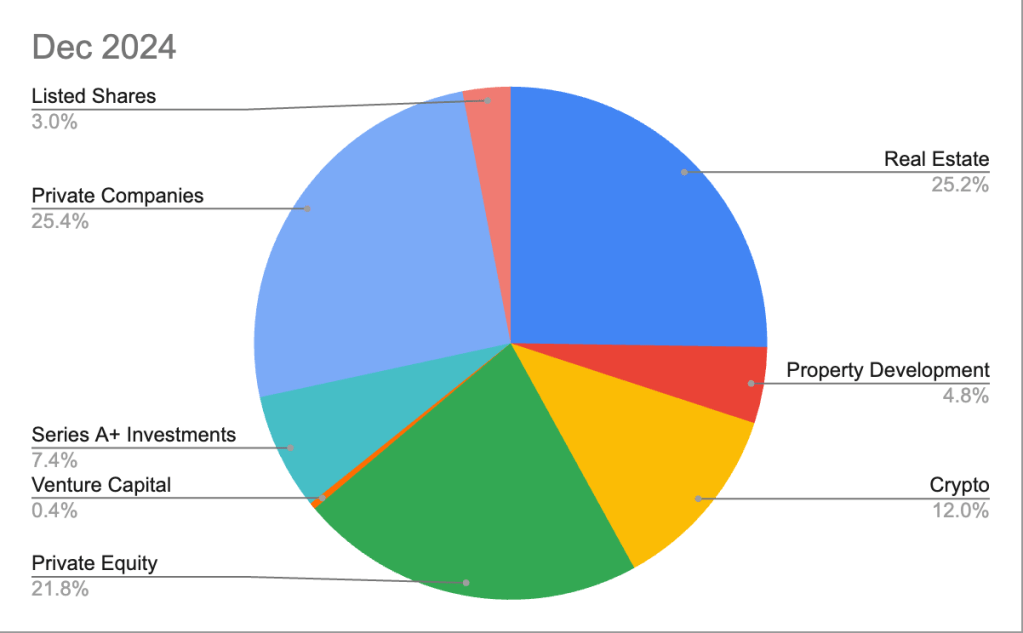

Regarding our portfolio structure, here’s how the weightings evolved from December 2022 to December 2024:

| Dec 2022 | Dec 2023 | Dec 2024 | 2024 Status | |

| Real Estate | 29.7% | 26.2% | 25.2% | Neutral |

| Property Development | 6.4% | 1.5% | 4.8% | Neutral |

| Crypto | 8.2% | 6.7% | 12.0% | Over Weight |

| Private Equity | 20.6% | 26.3% | 21.8% | Neutral |

| Venture Capital | 4.2% | 4.3% | 0.4% | Neutral |

| Series A+ Investments | 7.4% | Under Weight | ||

| Private Companies | 27.6% | 27.1% | 25.4% | Under Weight |

| Listed Shares | 0.5% | 1.2% | 3.0% | Under Weight |

| Cash | 2.8% | 6.7% | 0.0% | Under Weight |

| Total | 100% | 100% | 100% | |

| Debt | 16% | 28.9% | 29.16% | |

| Annual Return | 11.14% | 18.81% | 22.26% | |

| Portfolio IRR per Year | 11.14% | 14.91% | 17.31% |

Here is a pie graph that highlights the portfolio makeup at December 2024.

Below is a breakdown of the annual IRR per asset class and the number of years we have been achieving that return.

| IRR | Year Commenced | Years Compounding | |

| Real Estate | 3% | 2017 | 7 |

| Property Development | 0% | 2023 | 2 |

| Crypto | 25% | 2017 | 7 |

| Private Equity | 27% | 2020 | 5 |

| Venture Capital | 0% | 2019 | 6 |

| Series A+ Investments | 43% | 2021 | 4 |

| Private Companies | 57% | 2015 | 10 |

| Listed Shares | 53% | 2021 | 4 |

| Portfolio | 17.31% |

Below is a detailed breakdown of the performance and status of each asset class:

Real Estate

We expanded our portfolio with the acquisition of a property in Mayfield, Newcastle, in late 2024. This long-term rental complements our existing properties, all of which are performing as expected, delivering good gross rental returns.

Our IRR of 3% reflects the sunk costs and taxes associated with our recent acquisitions during 2023 and 2024, which will improve over time as these assets grow in value. Also, the IRR for real estate assets is somewhat misleading as it is based on the full asset value (including debt) rather than the cash on cash return from our investment.

- Status: Neutral – We are satisfied with the current allocation and do not plan additional adjustments in 2025.

Property Development

We have fully committed capital to a new development project in Burleigh Heads, QLD. With DA approval secured, we are negotiating with a builder and anticipate demolition to commence in February 2025, followed by a build period of 15–18 months.

- Key Challenges: Delays of approximately three months and cost overruns of 8%. Efforts are underway to compress costs to align with forecast profit figures.

- Status: Neutral – No additional property developments will be initiated until this project is completed.

Cryptocurrency

2024 was a standout year for our crypto investments, driven by the institutional adoption of BTC/ETH ETFs in the US and a rally following the US election.

We have a current IRR of 25% per annum for our crypto portfolio which reflects the annual compounded annual return since our initial investments in 2017.

- Status: Over Weight – In line with our 2.5-year crypto cycle plan, we began reducing positions and converting to cash in December 2024 and will continue to sell down through 2025.

- Some of the cash we are converting from the crypto system will be used to expand our share portfolio in mid 2025 when there is a correction with the NASDAQ. The remainder of the cash will be used as dry powder to support cash flow and also allow for deployment to other investments that arise.

Private Equity

One of our private equity (PE) investments experienced a markdown, while the valuation of a larger holding remained stable. A potential exit from the larger PE investment is anticipated in the second half of 2025, with significant returns expected.

We have a current IRR of 27% for these investments representing a healthy compounded annual return of 27% since 2020.

- Status: Neutral – No additional investments are planned for 2025. Once we have cashed out on the larger PE deal we will look to deploy some of that cash to additional PE investments.

Venture Capital

One notable VC investment transitioned to a Pre-IPO round and was reclassified as Series A +. Smaller VC capital plays were made in tech, but the risk-reward profile limits further significant allocations.

- Current IRR: 0%

- Status: Neutral – Minimal future investments expected in this asset class as it no longer aligns with our investment philosophy.

Series A +

Our investment in a Pre-IPO company, now reclassified as Series A +, continued to show strong growth. We also invested in Circle, the owner of USDC Stablecoin.

- Since investing in the Pre-IPO company in the initial seed round in 2020 we have experienced an IRR of 43% per year.

- Status: Underweight – Given the tailwinds for Stablecoins from the Trump administration and their pro-crypto stance we plan on doubling our allocation to Circle over the coming months.

Private Companies

Our conservative valuation approach has not dampened the performance of our private company investment, which saw significant revenue and profit growth. A small investment is currently being made in a cash flow-positive services business.

We have a current IRR of 57% compounded annually since 2015 when that initial investment was made. This is supported by not only the capital growth of that investment but the significant cash flows it generates on an annual basis.

- Status: Underweight – We aim to identify and invest in other cash-producing businesses as they become available.

Shares

We made significant increases to our share portfolio, focusing on tech, AI, and crypto. However, portfolio size was reduced in November to free up cash for the Mayfield property acquisition.

Also, some of the research houses we subscribe to have indicated the market could be topping out and is due for a 20% to 30% correction in 2025. In late December we implemented a hedge to protect some of the portfolio and plan to take advantage of any drawdown by purchasing quality AI/Tech based stocks and ETFs.

- Status: Underweight

Aiming for a 15% to 20% allocation within 2 years, with planned additions in 2025. - The plan is the shift capital from Crypto to Shares focussing mainly on tech and AI.

Financial Tools

- Cash: Current reserves are close to $0 following the repayment of a medium-term loan. We plan to rebuild reserves for future flexibility.

- Debt: Portfolio leverage increased slightly to 29.16%, staying below our 30% cap. During the year we did breach the 30% cap but with the most recent loan repayment this has been resolved.

Focus for 2025

Looking ahead, our strategy remains grounded in disciplined allocation and risk management. Priorities include:

- Completing the Burleigh Heads development and optimizing costs.

- Selling down crypto assets as the bull market begins to peak

- Incrementally increasing cash reserves for greater liquidity.

- Strengthening our share portfolio to meet the 15% to 20% target allocation.

- Exploring opportunities in Series A + and private companies with growth potential.

We remain committed to delivering sustainable returns and meeting our benchmark of 14% while maintaining a balanced and diversified portfolio.