In a world where understanding and conviction around the value of cryptocurrency can be rare, stablecoins emerge as a beacon of reliability. Often, when discussing the crypto landscape with those not yet converted, a common refrain is the struggle to grasp its intrinsic value. Despite the relentless pitches about Bitcoin’s potential, many remain unconvinced. However, delving deeper into the stablecoin market reveals a compelling narrative—the true embodiment of crypto’s practical application in the real world.

What exactly is a Stablecoin?

It’s a cryptocurrency meticulously designed to maintain a stable value, typically pegged to tangible assets like fiat currencies or commodities. Unlike the volatile rollercoaster rides of Bitcoin and Ethereum, stablecoins offer a steady anchor amidst the turbulent seas of digital currencies.

Let’s dissect the stablecoin universe:

Fiat-Collateralised Stablecoins:

These tokens find their stability in reserves of fiat currency, securely held in bank accounts or trusted custodians. Tether (USDT) and Circle (USDC) lead the pack in this category.

Crypto-Collateralised Stablecoins:

Backed by other cryptocurrencies held as collateral, stablecoins like DAI and sUSD (Synthetix USD) exemplify innovation in the blockchain space.

Algorithmic Stablecoins:

Free from the shackles of collateral, these stablecoins rely on algorithms to maintain their stability. Terra (LUNA) once shone as an example until its spectacular collapse in May 2022 (when the stablecoin depegged wiping out almost $45 billion market capitalization in one week), highlighting the risks inherent in this model.

Success of Fiat-collateralised Stablecoins

Fiat-collateralized Stablecoins have garnered significant global traction, particularly in providing stability within the cryptocurrency market. The emergence of these stablecoins dates back several years, with various projects aiming to address the need for stability in the volatile crypto space. While the concept of pegging digital assets to fiat currencies has been around for some time, the specific development of fiat-backed stablecoins gained momentum around 2014.

Among the earliest fiat-backed stablecoins was Tether (USDT), launched in 2014. It quickly became one of the first and most widely used fiat-backed stablecoins, primarily serving as a tool for crypto investors to mitigate the volatility associated with assets like BTC and Ether. Initially claiming to be fully backed 1:1 by US dollars held in reserve, Tether’s transparency and reserve adequacy have been subject to scrutiny and controversy over time

Following Tether’s lead, other fiat-backed stablecoins emerged, including USD Coin (USDC), launched in 2018 by Centre, a consortium founded by Circle and Coinbase. Like TrueUSD (TUSD) and Paxos Standard (PAX), both also launched in 2018 by TrustToken and Paxos, respectively, USDC aims to be fully backed 1:1 by US dollars held in reserve or escrow accounts.

These stablecoins have played pivotal roles in providing stability and liquidity within the cryptocurrency ecosystem. They serve as essential tools for traders, investors, and individuals seeking to utilise cryptocurrencies while mitigating the inherent volatility risks associated with other digital assets.

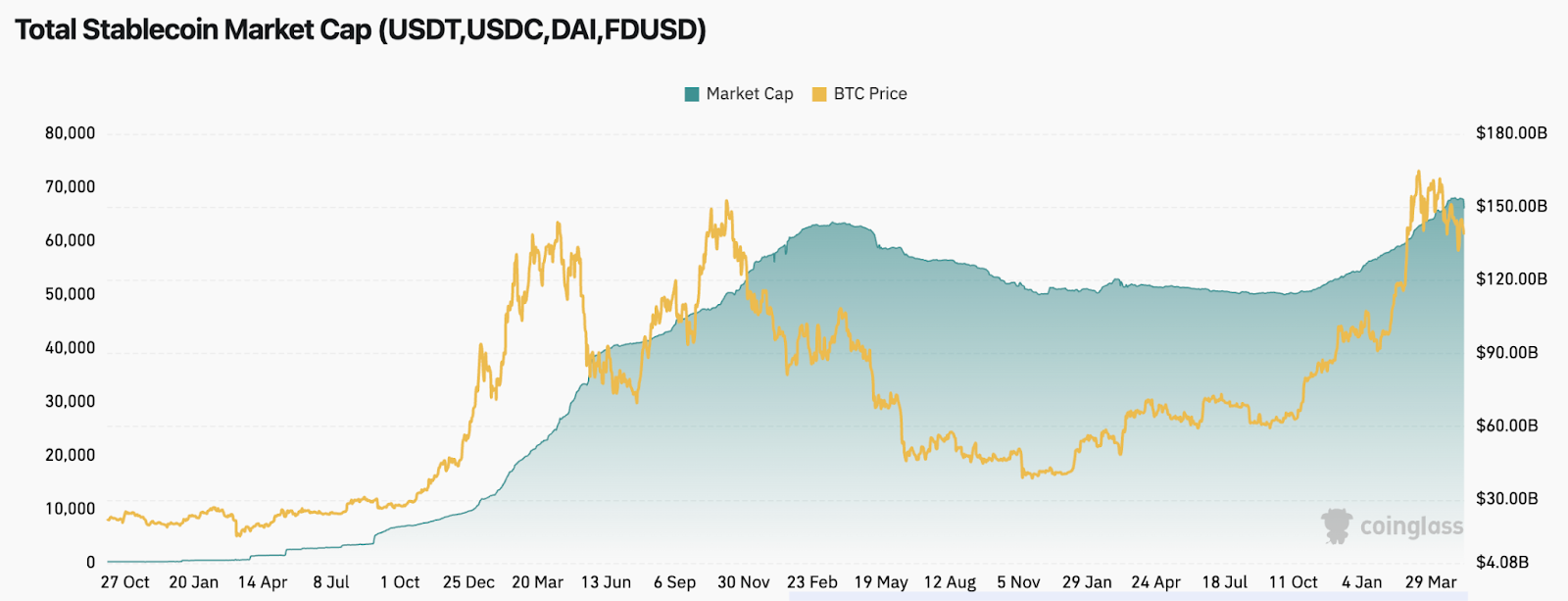

Stablecoins Non-Correlation to the Crypto Market Cycle

Since their inception, stablecoins have distinguished themselves as one of the few token categories capable of maintaining market capitalisation across both bullish and bearish market conditions. Unlike major cryptocurrencies like Bitcoin and Ethereum, which often experience significant fluctuations, stablecoins have demonstrated remarkable stability in market capitalisation. While most cryptocurrencies tend to correlate in terms of market movements, stablecoins stand apart by defying this trend. This can be seen in the graph below that highlights BTC price to stablecoin market cap since 2018.

The consistent market capitalization of stablecoins underscores the growing preference among users to retain their stablecoin holdings within the cryptocurrency ecosystem rather than redeeming them for fiat currency. This observation highlights stablecoins’ increasing recognition as a reliable store of value within the crypto space.

So what is driving this growth in stablecoins?

Other than the original use case for stablecoins being the ability to swap from volatile cryptocurrencies to a crypto that is pegged to USD there have been other use cases developed as per below.

- On-Ramps and Off-Ramps: Acting as bridges between traditional fiat currencies and cryptocurrencies, stablecoins facilitate seamless conversions, offering users unparalleled flexibility in navigating the financial ecosystem.

- Reduced Volatility: In a market notorious for its wild price swings, stablecoins provide a tranquil harbour for investors, merchants, and consumers alike, shielded from the tempestuous whims of the crypto seas.

- Cross-Border Transactions: With stablecoins, borders blur, and barriers vanish. Facilitating swift and cost-effective cross-border transactions, they empower individuals and businesses to transact globally with ease.

- Financial Inclusion: Stablecoins are not just tokens; they are instruments of empowerment. In regions plagued by economic instability (estimated 3 billion people), they offer a lifeline to the unbanked and marginalised, providing access to stable, globally accepted currencies.

- Yield and Income Generation: Centralised and decentralised exchanges provide holders of stablecoins with interest or yield for the coins they deposit on their platform. The yield amount may align with the interest rate offered by the currency’s government or even surpass it, potentially doubling the standard rate.

- Store of Wealth: Amidst economic turmoil, stablecoins emerge as beacons of hope, enabling individuals to safeguard their savings and engage in commerce without fear of value erosion. Its estimated that over 70% of crypto transactions in Argentina are USd pegged stablecoins.

- Self-Custody: Decentralised and personal digital wallets afford users unprecedented autonomy and security, mitigating the risks associated with centralised entities and governmental interference. Avoids situations like in 2013 when the Greece government confiscated 47.5% of citizen’s bank accounts that were above €100,000.

- Smart Contract Applications: Integrating stablecoins into smart contracts unlocks a world of possibilities, from decentralised finance (DeFi) protocols to automated trading and beyond.

- Regulatory Compliance: Stablecoins uphold trust and transparency by adhering to stringent regulatory standards, marking a significant step towards legitimacy and accountability in the cryptocurrency sphere. For instance, as they operate on blockchain technology, there is enhanced transparency regarding the ownership of stablecoins, mitigating the risk of money laundering and terrorism financing.

In summary, stablecoins serve as cornerstones of stability, linking traditional finance with the dynamic realm of cryptocurrencies. Their steadfast reliability and diverse applications provide a glimpse into a future where financial inclusion, accessibility, and utility reign supreme.

Stablecoins are challenging the existing banking and finance industry providing a much better experience and inclusiveness for any business and human across the globe. Here is video produced by Circle explaining this concept further.

In my view, stablecoins serve as tangible examples of how blockchain technology is being adopted and utilised by consumers and businesses worldwide. As they become increasingly integrated into various technologies and platforms we use daily, I anticipate stablecoins’ market capitalization will continue to soar.