Reflecting on 2022, it was a challenging yet pivotal year for our portfolio, marked by significant market turbulence but also key opportunities across various asset classes. While we faced a shifting macroeconomic landscape, our portfolio weathered the storm returning 11.14% for the year that although this is below our target of 14%, it was an excellent return given the macro environment.

The year began with the onset of aggressive monetary tightening policies, as central banks worldwide, including the U.S. Federal Reserve and the Reserve Bank of Australia, initiated a series of sharp interest rate hikes to combat soaring inflation. These rate hikes were the fastest in decades and sent shockwaves through both equity and bond markets, causing significant repricing across asset classes.

In the equities market, 2022 was characterised by heightened volatility, particularly in technology stocks, which had previously experienced a pandemic-fueled boom. The Nasdaq faced significant pullbacks, driven by rising rates and concerns over lofty valuations. However, certain defensive sectors, such as energy and healthcare, outperformed, benefiting from global supply chain disruptions and increased demand in the wake of the ongoing Russian-Ukrainian conflict.

The real estate market, especially in Australia, saw mixed fortunes. While property prices in some areas experienced a cooling-off period due to rising interest rates, certain blue-chip suburbs continued to demonstrate resilience. Capital cities like Brisbane and Sydney saw price fluctuations, but select premium locations managed to maintain moderate growth, defying broader market expectations.

In cryptocurrencies, 2022 was a turbulent year, following the remarkable bull run in 2021. The collapse of major platforms like FTX and Celsius sent shockwaves through the crypto sector, with Bitcoin (BTC) dropping over 60% from its all-time highs. Despite the turmoil and bankruptcies, long-term crypto investors remained optimistic about the underlying technology. Though 2022 ended on a bearish note for crypto, the sector set the stage for recovery in 2023, as it proved more resilient than many had anticipated.

The private equity and venture capital spaces also faced headwinds, as higher interest rates made growth capital scarcer and IPO activity dwindled. However, our portfolio remained insulated from much of this turbulence. Despite the broader challenges in these markets, several of our PE investments continued to perform well, buoyed by positive revaluations. Notably, one of our funds successfully took advantage of market conditions, acquiring undervalued, cash-flow-positive companies at favorable prices, which positioned the fund well for future growth.

Looking back, 2022 tested the resilience of many sectors, but it also created opportunities for disciplined investors. The year’s volatility and uncertainty laid the groundwork for the eventual market rebound in 2023, with the lessons learned serving to reinforce our long-term investment strategies.

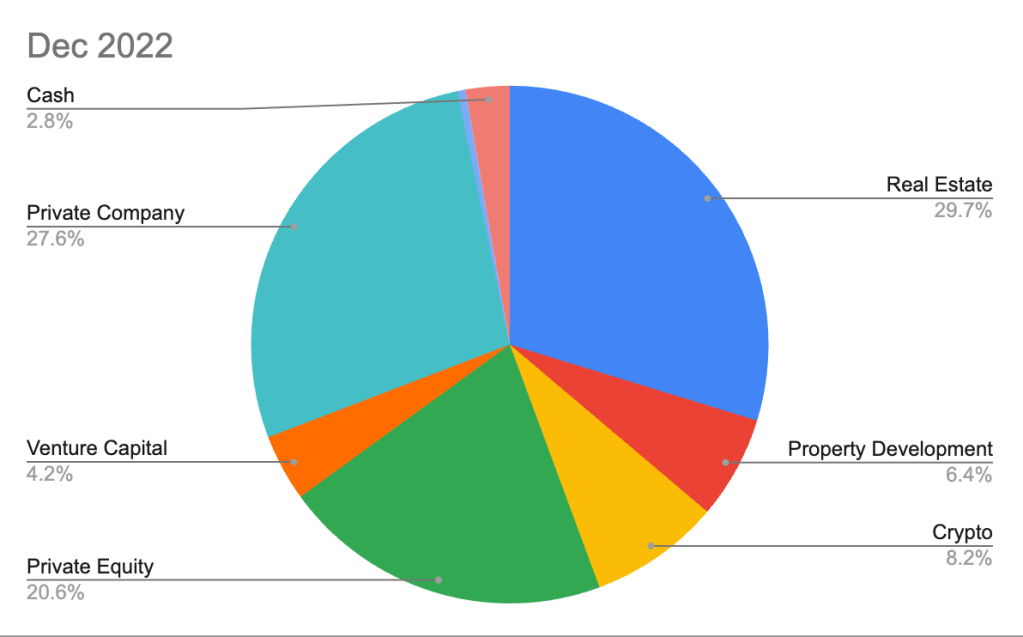

Portfolio Breakdown

Regarding our portfolio structure, here are the weightings at December 2022:

| 2022 | 2022 Status | |

| Real Estate | 29.7% | Neutral |

| Property Development | 6.4% | Neutral |

| Crypto | 8.2% | Neutral |

| Private Equity | 20.6% | Under Weight |

| Venture Capital | 4.2% | Neutral |

| Private Companies | 27.6% | Neutral |

| Listed Equities | 0.5% | Under Weight |

| Cash | 2.8% | Neutral |

| Total | 100% | |

| Debt | 16% | |

| Portfolio Annual Return | 11.14% | |

| Portfolio IRR per Year | 11.14% |

Here is a pie graph that highlights the portfolio makeup at December 2022

Real Estate

The portfolio remained unchanged during the calendar year as we digested changes in asset values as a result of interest rate increases.

Status: Neutral – We are content with the deployment across this sector. However, as market conditions adjust we may look to adjust the portfolio make-up during 2023.

Property Development

We have a completed property development in an NDIS property that we have leased out and hold as a rental property.

Status: Neutral – We are comfortable with this allocation but may look to add additional NDIS properties if we can achieve an attractive yield.

Crypto

We experienced significant losses in our crypto holdings, including both tokens and NFTs, over the course of the year. However, toward the end of the year, we made the decision to double down by deploying additional capital into the asset class, particularly through the purchase of Ether. It appears that the market has bottomed out, and we’re now seeing a gradual upward trend.

Status: Neutral – We won’t deploy further capital into crypto and will aim to see the portfolio grow to around 15% over the next few years.

Private Equity

There were no new capital commitments in this area, only a few capital calls on investments we had already committed to.

Status: Under Weight – There is an opportunity to deploy additional funds in a PE business that we are close to agreeing on.

Venture Capital

Our VC investments remained unchanged.

Status: Neutral – No adjustments planned for 2023.

Private Company

Our software company investment had a slight valuation increase which supported growth here.

Status: Neutral – Content with the current allocation, but open to deploying capital for suitable opportunities.

Shares

We took a bit of a beating with some of our tech equities, in particular some of the Crypto banks (one of those shares going to $0) and tech stocks like Meta depreciating.

Status: Underweight – We will start to deploy additional capital to this asset class now that prices are quite attractive.

Financial Tools

Cash

We maintain minimum cash reserves as needed.

Debt

Leverage currently stands at approximately 16% of the portfolio’s value. We may look to increase this slightly if we decide to restructure the real estate holdings.

Notes: The portfolio percentage make-up along with the IRR reflects the net value of assets (value less any debt) in the portfolio. It also takes into account income derived from any assets less expenses (business and personal of our family including living costs), interest payments and taxes paid over the calendar year.